Ping! Your cell phone makes a noise and you check who the text message came from.

We’ve all been well trained to keep our phones nearby and to check and respond quickly to text messages. Once in a while, instead of it being your friend, spouse, parent or child, it’s a scary warning from your bank, or the tax department telling you to contact them because something has happened to your account. At this time of year in Canada and the US, we’re all on extra alert, and some cool headed thinking can prevent great financial losses.

Identifying a scam

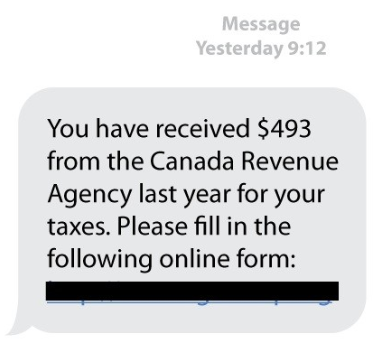

Text messages are a great addition to our list of communication tools. If I’m in the grocery store and my wife wants me to pick up a few more items, I’ll tell her to send me a text with the list – don’t call me as I’ll forget as soon as we get off the phone! However, as with any helpful tool, there is always someone who finds a sinister misuse for it. It’s not uncommon, especially during the tax season to get a message like this:

There’s a common pattern in scam messages, also known as phishing (as in fishing for information). The scammer wants to either scare you into action or promises you some reward – like the supposed $493 from the Canada Revenue Agency. These types of texts will have a link that, when clicked, appears to be a trusted organization like your bank. Do not click on these! You will be asked for your user name, password and possibly other private information. The scammer will use these to steal your banking or other financial resources.

But not all texts are phishing

The banks and other financial institutions have also started using text message alerts as a notification system. But how do you tell the difference? Have a look at this message:

In this message, it appears to be coming from TD Bank and is asking if you spent a specific amount at a specific vendor. It asks you to respond either with “Y” that you made this purchase (and all is ok) or “N” for no that you didn’t make this purchase (and all is not ok).

The difference – in the scammer text, you are asked to provide your personal information. In the second, you are only being asked to confirm or deny information. At no time is any personal details exchanged.

So, now you know that scam messages will ask you to click a link, or call a phone number. Notification alerts only ask you to confirm or deny information. For any type of alert where you are not sure, you can call to a known phone number from your bank and find out if the alert is true or not. By understanding the different types of messages you may get, you will always be in control and have the right response.

Sometimes it looks like a scam but it’s not

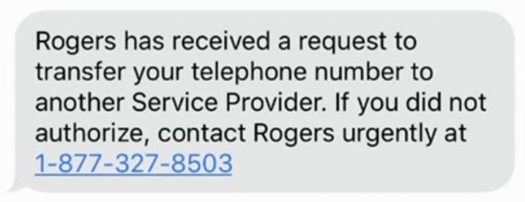

Recently I read about a new scam going around – scammers attempting to port phone numbers illegally:

In this scam, the scammer was able to determine just enough personal information about someone that they could call the cell phone provider and have the number moved to another provider. A text message was sent to their phone but the original owner either didn’t see it in time or thought it was a scam – a valid response based on how’ve we’ve been trained to react.

Once we have been trained to ignore what seems to be a scam message, what should a cell phone owner to do with this new information?

When you receive what appears to be a phishing text, if you aren’t sure if it’s valid, contact your bank, cell phone provider or whichever company is referenced. Do not use the number or website in the text! Look it up either through your contacts, the back of your credit card or through the provider’s official website.

Most mobile phone providers in the US offer blocks to prevent your phone from being ported unless you provide them with a pin number that you set up. The following article explains this process https://www.thebalance.com/prevent-your-mobile-number-from-being-ported-4160360 and you can call your Canadian (or other) provider to find out if they offer such an option

Always be vigilant

This tax season while you are busy enough getting all of your papers and files in order to submit your taxes, it’s more than likely than before that you’ll get phishing texts or phone calls from scammers. Remember that the tax agencies will never call, text or email you with threatening messages. You can always call them at officially listed numbers to find out if there is indeed a problem. When the inevitable scammer comes calling, take a breath, think about your options and then make the right decision to shut them out.